Back to Learning Resources

Environmental Management Accounting

Quantify the material and energy costs associated with waste as well as end products

Tags:

Also known as Material Flow Cost Accounting (MFCA), this accounting technique is an environmental management tool that uses detailed analysis of process inputs and outputs to accurately quantify the material and energy costs associated with waste as well as end products.

Inputs include:

- Material costs (including major materials added at the beginning of the process, extra materials added during midstream processes, and supporting materials such as detergents, solvents, catalysts, cooling water, etc)

- System costs (including labor, depreciation,… – typical “overhead” costs)

- Energy costs (Electricity, fuel, utility)

- Waste treatment costs (waste collection fees, disposal fees, sewerage costs, waste transportation)

In contrast to traditional cost accounting, where waste costs are often hidden in various overhead accounts, MFCA applies energy and materials costs both to “positive” product output and “negative” waste output from each process.

Once the true cost of wastes are accounted for, companies often find that reducing waste is a better option than increasing waste recycling. This has a double benefit for both environmental and financial performance, reducing both waste and consumption of resources.

Armed with good information on where waste is generated, companies can better target investments to improve their processes.

This means that MFCA analysis of processes is also a good tool for prioritising projects aimed at improving quality.

Example:

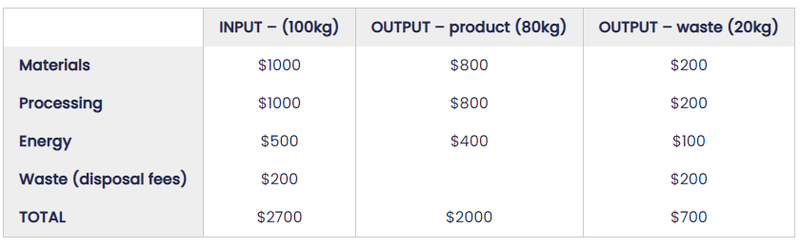

This process takes 100kg of input materials and results in 80kg of product. Costs attributed to this process include materials ($1000), labour and tools ($1000), and electricity ($500). Waste disposal fees are $200.

Traditional accounting would conclude that waste costs are $200 and all other costs are assigned to the production costs for the 80kg of product.

Materials Flow Cost Accounting (MFCA) assigns all costs proportionally to both product and waste.

Which reveals the true cost associated with the 20kg of waste is $700, and there is a bigger incentive to reduce it.

More resources:

There is a standard (released March, 2012): ISO 14051:2011, Environmental management – Material flow cost accounting – General framework

The Asian Productivity Organisation has an ebook available: Manual on Material Flow Cost Accounting: ISO 14051